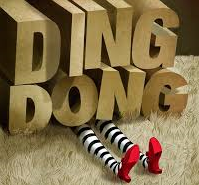

DING DONG…. WILL THE STRETCH IRA BE DEAD?

Many individuals own an individual retirement account (“IRA”) with a named beneficiary. Under current law, if the beneficiary is a designated beneficiary, then, when the owner dies, the designated beneficiary must take at least a minimum required distribution (“MRD”) in accordance with the Single Life Table. The designated beneficiary may take more distributions than the MRDs but must take at least the MRD.

In most circumstances, unless the IRA is a Roth IRA, distributions from the IRA are taxable. Spreading distributions as provided in the Single Life Table is favorable because the designated beneficiary does not have to pay income tax all in one year. They can pay the income tax as they receive the MRDs. Further, assets remaining in the IRA before distribution grow tax free until the MRDs are paid.

For example, Bill names his daughter, Julie as beneficiary of his IRA. He dies at age 80, with an IRA of $500,000 as of December 31 of the year he dies. His daughter is required to take an MRD the year after Bill’s death when she is 40. Under current law, Julie would look at the Single Life Table and find her remaining life expectancy of 43.6. Julie must take $500,000 divided by 43.6 or a $11,467.89 MRD. She can take more but she must take at least the MRD. For each subsequent year, she reduces the divisor by 1 so in the second year after Bill’s death, she must take the value of the IRA as of the December 31 of the prior year divided by 42.6 and so on for each year thereafter. If Julie only takes the MRD, the income tax payable is over the years she takes the distributions. This is known as the “stretch” IRA.

Over the years, Congress has looked at this issue. Many argue that the intent of the IRA stretch rules is to benefit the IRA owner, who needs the IRA for retirement, Bill in the example. The argument is that the favorable stretch should not benefit children and grandchildren. Legislation has been proposed over the past years without much movement.

However, the most recent proposed legislation, “Setting Every Community Up For Retirement Enhancement Act of 2019” (the “SECURE Act” or the “Act”) passed the U.S. House of Representatives with a vote of 417-3 in 2019. Currently, the Act is stalled in the Senate. As this author understands, Ted Cruz and his constituents, want 529 plans to apply to homeschooling, the version of which was dropped from the Senate version of this legislation.

So why is the SECURE Act so important to you and your clients? The primary reason and the reason you will hear in the media is that the stretch for IRA distributions payable to a beneficiary is dead!!!! While not always true, in the majority of cases the stretch will be dead because most beneficiaries will have to take their distributions from the IRA over 10 years.

The following are a few of the important

provisions of the Act:

- Three tiers of IRA beneficiaries- the eligible designated beneficiary, the designated beneficiary and the beneficiary who is neither an eligible designated beneficiary or a designated beneficiary.

- The eligible designated beneficiary continues to benefit from the current stretch.

- The designated beneficiary uses a new 10-year distribution period (note that the distribution does not have to be made ratably over 10 years but the IRA has to be paid out at least by 10 years).

- Beneficiaries other than eligible designated beneficiary or a designated beneficiary apply either the 5 year rule or the “ghost” life expectancy depending on whether the owner dies before or after his or her required beginning date (“RBD”). If the owner dies after his RBD, then the owner’s life expectancy (as noted in the table because obviously in “real life” there is zero life expectancy as the owner has died) can be used, hence the “ghost” life expectancy.

- Eligible designated beneficiaries are surviving spouses, disabled or chronically ill individuals, individuals who are not more than 10 years younger than the owner, minor children (OF THE OWNER OF THE PLAN) but only until they reach the age of majority.

- The designated beneficiary definition has not changed.

- Surviving spouse provisions are not changed.

- RBD changes from the 70 ½ age to age 72.

- No age restriction on contributions to IRAs, reflecting the longer time that individuals are working.

- A mismatch with the qualified charitable distribution which is age 70 ½ and the new RBD.

- Effective date is for those dying after 12/31/2019 NOT the time the trust is created if the owner has created an accumulation trust or conduit trust to be the beneficiary of the IRA.

- Inapplicable to defined benefit plan distributions.

- The legislation is not clear as to the effect on existing accumulation trusts. Existing conduit trusts could be a disaster.

- For example, assume a trust is a “see through” accumulation trust. A charity is a remainder beneficiary and the lifetime beneficiary is an adult child (under the proposed law, a designated beneficiary with a payout over 10 years). Under current law, the trust “fails” as a “see through trust” designated beneficiary because a charity is the remainder beneficiary and the payout would either be the remaining life expectancy of the owner or 5 years. If the owner dies after the owner’s RBD, the remaining life expectancy of the owner may be longer than 10 years. Which rule would apply? The 10 years, or the owner’s remaining life expectancy under the tables?

- As a disabled beneficiary is an eligible designated beneficiary, the current rules will apply but how will it affect special needs trusts which are beneficiaries of the IRA? Will the IRS focus on the life expectancy of the disabled beneficiary allowing the longer payout or will they look at the entire trust and take into account the remainder beneficiaries who are not eligible designated beneficiaries?

- If a disabled individual is no longer disabled, then the 10-year rule applies,

ADVICE: Keep a close eye on this legislation. Currently, the Act is effective for those owners dying after 12/31/2019 NOT for trusts created before 12/31/2019. Thus, if passed this year there is a VERY small window to plan for this Act, especially if a beneficiary of an owner’s IRA is a conduit or accumulation trust. While unfair for those that have been planning based on the stretch rules, who said Congress would be fair? Who knows whether Congress will pass the Act or not? Query… is this wise legislation knowing that individuals are not saving and these inherited IRAs may be necessary for the next generation’s retirement?

If the Act does pass, then consider making charitable remainder trusts the beneficiary to be able to stretch the deferral to the beneficiary. Consider other trusts so the IRA is not distributed outright to the spendthrift beneficiary. If an owner has died in 2019, then consider a disclaimer by the primary beneficiary if the contingent beneficiary is a young beneficiary to lock in the stretch IRA.

WORD OF THE WEEK: RESA is the Retirement Enhancement and Savings Act introduced previously in Congress which did not pass. RESA has some of the same provisions as the Act but, the very impractical provision providing that $450,000 could be utilized under current stretch provisions, was deleted from the Act. As a practical matter, it was unclear as to how the $450,000 would be allocated to different beneficiaries.

GENEROSITY IS A KEY TO HAPPINESS…REACH OUT AND HELP SOMEONE TODAY! 😎